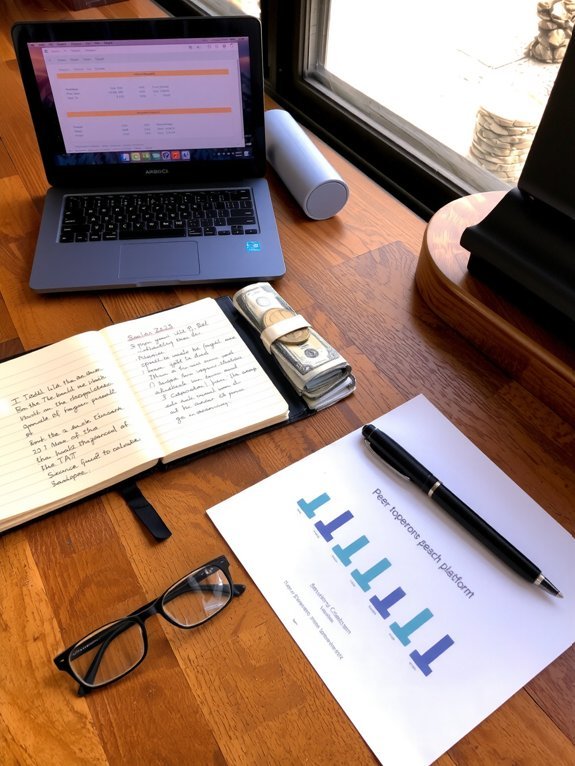

You’re sitting on cash and a stranger is offering you steady interest—oddly comforting and slightly risky at once. If you want to make money with peer-to-peer lending, I’ll show you how to pick platforms, spread bets across loans, read credit signals, and handle late payments, step by step; picture checking dashboards with a morning coffee, nudging overdue accounts, and letting compound interest do its slow, glorious work—but first, a quick reality check.

What Is Peer-to-Peer Lending and How It Works

If you’ve ever wondered what happens when your spare cash meets someone else’s loan request, welcome to peer-to-peer lending — and yes, it’s less awkward than a blind date. You fund loans on an online marketplace, I’ll walk you through peer to peer basics so you don’t feel lost. You pick borrowers, set amounts, diversify across many small notes, sip your coffee, and track repayments. The lending mechanics are straightforward: borrowers apply, platforms grade risk, you choose slices of loans, payments come back monthly with interest. You’ll see principal and interest hit your account, reinvest, or withdraw. It’s hands-on, with tiny thrills — like watching passive income drip into your balance, quietly satisfying, slightly smug.

Types of P2P Loans and Platforms to Consider

Because not all P2P loans taste the same, you’ll want to know which flavors are on the menu before you start stuffing your wallet. You’ll see personal loans—fast, plain, useful for debt consolidation or emergencies. Then there are small-business loans—robust, a bit spicy, higher returns if you’ve got patience. Secured loans, like those backed by property or vehicles, feel solid under your hands. You’ll also find niche slices: student, auto, and invoice financing, each with its own texture. Do a platform comparison, don’t just nibble at the marketing. Some marketplaces match you with dozens of tiny loans, others offer fewer, bigger slices. Test the interface, fees, secondary market, and customer service. Smell-test the risk, then take a bite.

Assessing Borrower Creditworthiness and Risk Factors

You want to know if a borrower can actually pay you back, so start with their credit score — it’s the loudest alarm or the quietest whisper about past behavior, and you should listen. Then smell the numbers: check income, employment history, and cashflow to see if wages cover bills and loan payments without tightrope walking. I’ll point out the red flags as we go, and you’ll learn to spot the confident payers from the ones who’ll make excuses.

Credit Score Analysis

Numbers tell stories, and I’m the nosy reader who won’t stop til I know the ending. You’ll watch the credit score importance jump off the page, like a neon sign you can’t ignore, because the credit score impact on default risk is real. I scan reports, squint at ranges, and mutter, “Nope,” or “Maybe.” You learn the sweet spots: high scores whisper safety, low scores scream caution. Look for patterns, not single slips; a recent recovery beats chronic missed payments, every time. Pull reports, compare models, and stress-test scenarios in your head — you’ll feel the numbers under your fingertips. Trust but verify, diversify, and let the scores guide your bets, not replace your judgment.

Income and Cashflow

When I dig into a borrower’s income and cashflow, I want to see breathing room — steady deposits, a rhythm to paychecks, and enough left over after bills so they don’t have to choose between groceries and rent. You check bank statements, watch the money breathe in and out, listen for irregular thumps that mean side gigs or intermittent freelance spikes. Look for stable payroll, recurring bills paid on time, and any passive income that cushions slow months. Ask about seasonality, inspect rent stubs or invoices, and flag big one-offs. If deposits are noisy, be wary. If the cash flow sings a steady tune, you loosen the grip; if it coughs, tighten it. Trust records, not charm.

Interest Rates, Fees, and How Returns Are Calculated

Because interest, fees, and the way returns get tallied are the parts that actually put money in your pocket—or chew it up—you’ll want to pay attention from the jump. You’ll watch interest rate fluctuations like a hawk, because rates rise and fall, and that changes what you earn; you’ll learn fee structures, platform fees, and servicing charges, because they nibble at your gains. Calculate net return: subtract fees, account for loan performance, add recovered amounts. I poke numbers, squint at statements, and grimace when a fee sneaks up. Be realistic, don’t daydream about unicorn returns. Here’s a quick visual:

| Item | Effect |

|---|---|

| Interest rates | Drive gross yield |

| Platform fees | Reduce income |

| Late fees | Offset losses |

| Recovery amounts | Boost net returns |

Diversification Strategies to Reduce Default Risk

Alright, you’ve stared at the numbers, wrestled with fees, and learned how returns actually show up in your account—now let’s spread the risk so one sad borrower can’t ruin your day. You’ll use loan diversification, sprinkling small bets across many loan types, and lean into borrower segmentation so a single sector slump won’t tank you. Think of risk allocation like seasoning, a pinch here, a dash there. Your investment strategy should include portfolio balancing, setting max exposure per grade, and scanning market trends and economic factors that shift default odds. Walk the platform, click cautiously, shift slices when unemployment ticks up. It’s simple, steady, slightly nerdy, and oddly satisfying.

Automating Investments vs. Manual Loan Selection

If you hate tedious clicking and love the idea of your money quietly doing its job while you sip coffee, automated investing is like hiring a reliable robot assistant who never needs snacks; if you’re the obsessive type who enjoys the tiny thrill of picking individual loans, manual selection is more like craft brewing — fiddly, fun, and occasionally glorious. I’ll say it straight: automated strategies save you time, reduce decision fatigue, and follow rules you set once. You wake, check a graph, smile. But if you crave control, manual preferences let you sniff out deals, read profiles, reject smells you don’t like, and feel alive. Both work. Mix them. Start automated, sprinkle manual, adjust as you learn.

Tax Implications and Record-Keeping for P2P Income

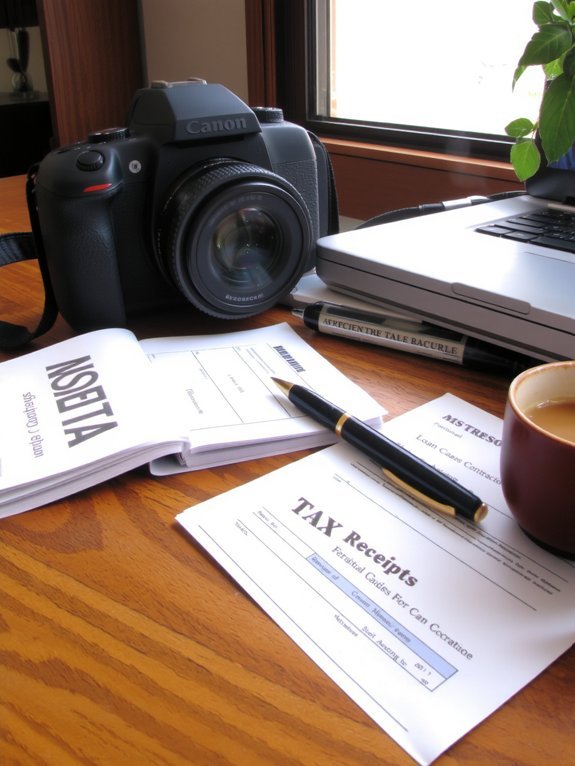

You’ll want to know which P2P earnings count as taxable income, and I’ll walk you through what needs reporting so the IRS doesn’t surprise you. Keep careful records of interest received, note any charged-off loans for deductible losses, and save statements, screenshots, and exportable CSVs like a squirrel hoarding receipts. I’ll show simple, practical record-keeping habits that keep your tax prep calm, your deductions defensible, and your late-night worry manageable.

Taxable Income Reporting

Because taxes don’t care how thrilled you were when that first P2P payment hit your account, you’ve got to treat lending like a small business—even if it feels more like collecting pocket change. You’ll log interest, fees, and platform statements, because tax regulations demand clear income reporting. I recommend downloading CSVs, snapping screenshots, and saving payment emails — tactile proof so you won’t sweat audits.

| Item | Action |

|---|---|

| Interest | Record per loan, per date |

| Platform Forms | Save 1099s or equivalents |

| Payments | Reconcile monthly totals |

Keep a running spreadsheet, label deposits with loan IDs, and date every note. When in doubt, ask a CPA; I do. You’ll sleep better, and that’s priceless.

Deductible Losses Tracking

A little bookkeeping will save you from a lot of tax-time sweating, so let’s talk deductible losses and how to track them like a pro — or at least like someone who didn’t panic when a borrower ghosted them. You’ll want to log defaults, settlement amounts, and charge-offs, in a simple list that smells faintly of coffee and late-night spreadsheets. I tell you this because loss tracking isn’t glamorous, it’s survival. Note dates, original principal, payments received, and any collection costs, so you can meet reporting requirements without guessing. When a loan dies, document your attempts to collect, a short note will do. That paper trail lets you claim deductions confidently, and keeps your tax return from becoming a drama.

Record-Keeping Best Practices

If you want to keep your taxes calm and your accountant grateful, start by treating record-keeping like a small, stubborn pet you actually enjoy feeding — regular, obvious, and impossible to ignore. You’ll collect statements, interest reports, and loss docs, smell the paper, click the PDFs, and sigh with relief. Use record keeping tools and financial software, sync accounts, tag income, label defaults. Backups are non-negotiable. I speak from hard-earned pain; once I lost a year, it stung.

| What to save | Why it matters |

|---|---|

| Statements & 1099s | Proves income, avoids audits |

| Loan notes & defaults | Validates losses, supports deductions |

| Exported ledgers | Easy import to financial software |

Stay tidy, routine beats panic, and your refund will thank you.

Handling Delinquencies, Recoveries, and Charge-Offs

Three things will ruin your day faster than a missed payment: silence, surprise, and stubborn spreadsheets — and I’ve stared down all three. You’ll want a tight delinquency management playbook, pronto. Call early, send polite but firm reminders, log every tone and timestamp, and don’t let things fester. When calls cool, pivot to clear recovery strategies: negotiate payment plans, request partial settlements, or escalate to the platform’s collections team. Track receipts, document offers, and smell the stale coffee of persistence — it helps. Eventually some loans hit charge-off; accept that, claim tax deductions where allowed, and archive the file like a battle scar. You’ll learn fast: patience, paperwork, and a blunt sense of humor save money, and your sanity.

Building a Sustainable P2P Portfolio and Risk Management

When you stop treating each loan like a lottery ticket and start thinking like a gardener, you’ll do a lot less panic-waterings and a lot more steady pruning — I learned this the hard way, hands in the soil, coffee cooling beside me, spreadsheets glaring like an accusing clock. You set risk tolerance, diversify by grade, and check in, not obsess. You rebalance quarterly, sell notes if one sector wilts, and let compounding do its quiet work. I talk to my portfolio like a houseplant, firm voice, gentle snip. You’ll sleep better.

| Action | Why it helps |

|---|---|

| Set risk tolerance | Prevents panicked buys |

| Diversify grades | Spreads defaults |

| Portfolio rebalancing | Keeps target mix |

| Monitor loans | Catch trouble early |

Conclusion

You can make P2P lending work, but you’ve got to treat it like tending a small garden: plant diversely, water regularly, pull the weeds fast. I’ll be blunt — don’t chase unicorn returns. Check credit, spread risk, reinvest interest, and automate a bit so you don’t babysit every loan. Keep tidy records, expect some losses, and pivot when trends change. Do that, and you’ll grow steady income, not drama.