Sunlight spills across your desk, coins clinking softly in a mug—you can turn that quiet into steady income. I’ll show you how to sharpen the skills, set up a slick home workflow, and package services so clients actually pay on time, not “eventually”; you’ll learn where to find clients, how to price confidently, and when to outsource the boring stuff. Stick with me, and we’ll make bookkeeping work for your life—not the other way around.

Why Choose Remote Bookkeeping: Benefits and Realistic Expectations

If you’re tired of commuting, office chatter, and fluorescent lighting that makes your skin look like a ghost, remote bookkeeping might be your ticket—no cape required. You’ll trade cubicle hum for the click of your keyboard, the smell of coffee, and a window you actually like. Remote work gives you job flexibility, so you set hours around school runs, workouts, or naps—yes, naps count. You’ll balance ledgers and life, nudging work life balance toward sane. Expect quiet wins, steady clients, occasional tax-season chaos, and learning on the fly. You can aim for financial independence, not overnight riches but steady income that grows. I’ll be frank: it’s discipline plus charm, spreadsheets plus people skills, and yes, you’ll probably wear slippers.

Essential Skills, Certifications, and Tools to Get Started

You’ve seen the perks — slippers, coffee steam, and reclaiming three hours a day from rush-hour purgatory — but now we get practical. You’ll need sharp basics: math comfort, tidy organization, and real financial literacy, not just spreadsheet bravado. Get certified? Yes, a quick bookkeeping certificate or Xero/QuickBooks accreditation fast-tracks trust. Learn bookkeeping software hands-on, stumble, then master shortcuts. Practice reconciling, invoicing, payroll snippets, and client chats. Keep learning.

| Skill | Certification | Tool |

|---|---|---|

| Reconciliation | Bookkeeping Certificate | QuickBooks |

| Invoicing | Xero Advisor | Xero |

| Payroll basics | Payroll Course | Excel/Sheets |

Start small, take gigs, ask dumb questions, sip coffee, fix mistakes, and watch steady income grow.

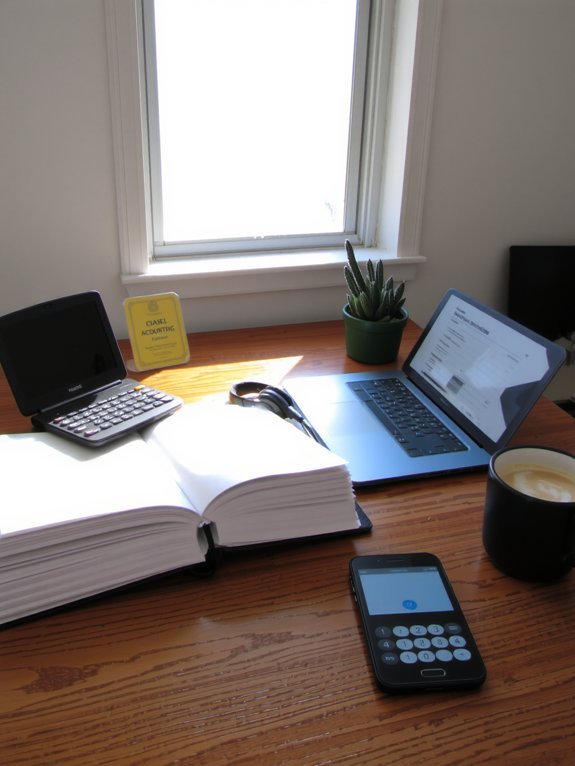

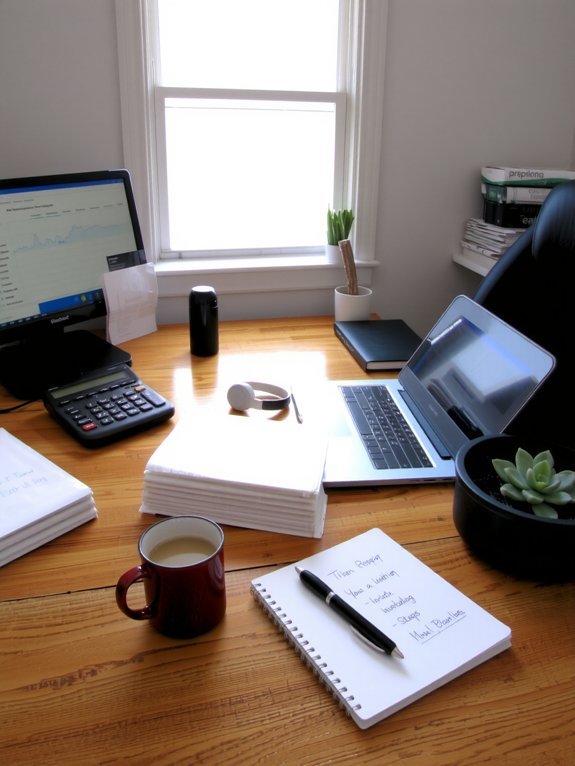

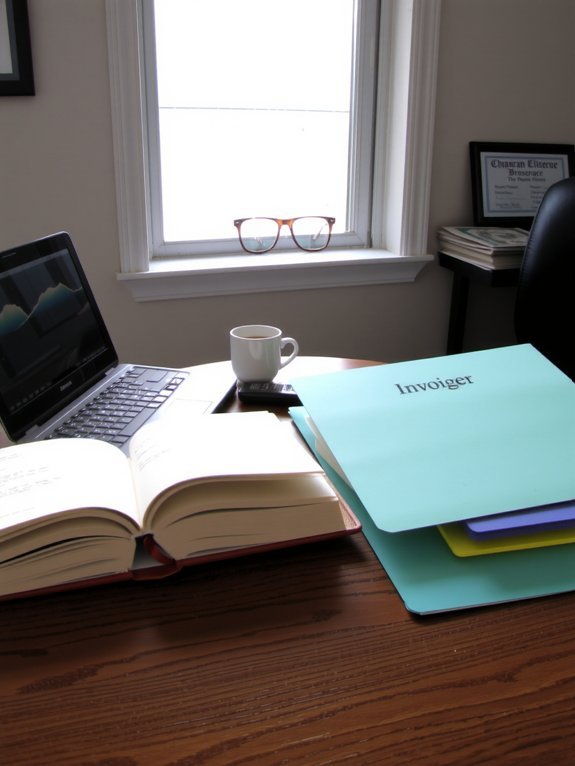

Setting Up Your Home Office and Accounting Software Workflow

Once you carve out a nook that isn’t your laundry pile, make it feel like a tiny business HQ — I mean, you’re about to invoice humans for money, so look the part. Set a desk, comfy chair, good light, a plant that pretends to survive. I tell clients I work in a command center; you’ll want that vibe. Mount shelves, stash receipts, dampen noise with rugs. Then pick accounting software that fits, test run it with fake clients, learn shortcuts, keyboard combos, and your pet won’t crash the ledger. Backups are non-negotiable — cloud plus local. Create a simple workflow: intake, categorize, reconcile, review, deliver. Label cables, set a timer, brew better coffee. You’ll be tidy, fast, and oddly proud.

Creating Service Packages and Pricing Your Bookkeeping Work

Okay, let’s map out how you’ll package and price your bookkeeping so clients get clarity, and you get paid what you deserve. Start with tiered service packages — basic, pro, and premium — so prospects can see what they’re buying, then use value-based pricing to charge for the business outcome, not just hours (yes, that means you can charge more). Offer add-on options like payroll, tax prep, or monthly analytics reports, and make them pop on your pricing page with short, tasty descriptions that smell like confidence, not confusion.

Tiered Service Packages

If you want clients who actually pay on time and stick around, stop offering one-size-fits-all bookkeeping and build tiered service packages instead — think of them like coffee orders: basic drip, fancy latte, and the occasional triple-shot you only serve to VIPs. You’ll use tiered pricing to set expectations, and clear service levels so nobody’s surprised. I put them in simple tiers, you pick a plan.

| Package | What’s Included |

|---|---|

| Basic | Monthly reconciliations, reports |

| Standard | Everything Basic, payroll, invoices |

| Premium | Weekly books, tax prep, support |

| VIP | Dedicated month-end, advisory |

Make names tasty, prices obvious, and add a “why upgrade” line. Sell outcomes, not hours.

Value-Based Pricing

Think of value-based pricing as the menu you actually want to eat from — not a boring list of hours and numbers, but a promise that the client can taste: less stress, cleaner books, and time back in their week. You sell outcomes, not minutes. Start by mapping client pain points — late invoices that smell like regret, tax fear that keeps them up — then assign dollar value to relief. That value perception guides your pricing strategies. Build packages named for results, not tasks. Say “Profit Pulse” for monthly insight, not “10 hrs bookkeeping.” Pitch confidently, back your claims with examples, and watch clients nod, relieved. You’ll feel cheeky charging for peace of mind, and they’ll happily pay.

Add-On Service Options

Alright — you’ve sold peace of mind with value-based pricing, now let’s stack the menu with irresistible extras. You’ll craft add on services like payroll setup, monthly cleanup, or quarterly tax prep, each with clear deliverables, a tiny checklist, and a punchy price. Offer tiered packages — basic, popular, and VIP — so clients see choices, not confusion. Bundle a fast-response hotline or quarterly strategy call to boost client retention, sprinkle in a discounted annual prepaid plan, and watch sticky relationships grow. Pitch with concrete benefits, a short demo, and a visible savings example. Be bold, tweak prices after feedback, and don’t be shy about saying, “This will save you headaches—and hours.”

Finding Clients: Marketplaces, Networking, and Cold Outreach

Where do your clients live—on freelancing sites, in networking groups, or hiding behind unreturned emails? You’ll troll freelance platforms, set up referral programs, post on social media, and doorstep local businesses, all with a grin and coffee breath. I’ll nudging you: try virtual networking events, join professional associations, and stalk niche markets like vegan bakeries or indie designers. Send crisp email campaigns, follow up with a phone ping, then pivot if silence persists. Be playful, offer a free mini-cleanup, and watch doors open. Track replies, tweak your pitch, celebrate small wins, repeat. It’s messy, tactile work—keyboard clacks, nervous laughs, real handshake energy—doable, profitable, and oddly fun.

Client Onboarding, Recordkeeping, and Maintaining Relationships

Once you win a client, the real fun starts—onboarding is where you turn a stranger’s chaos into tidy books, and where you either charm them for life or scare them off with jargon. You’ll guide them through the onboarding process, ask for access, passwords, and receipts, and keep client communication crisp, friendly, and frequent. You set expectations, show a sample ledger, and smell coffee while sorting invoices — strangely satisfying.

| Step | Visual | Action |

|---|---|---|

| Welcome | Handshake emoji | Send welcome pack |

| Access | Laptop screen | Configure software |

| Records | Stack of receipts | Organize folders |

| Follow-up | Calendar | Schedule check-ins |

Keep records neat, send summaries, and be human — realistic, reliable, a little charming.

Managing Taxes, Invoicing, and Legal Protections for Your Business

You’ve got tidy folders and a friendly cadence with your clients, now let’s talk about the money parts that keep the lights on—taxes, invoicing, and the legal stuff that stops nightmares before they start. You’ll set up invoicing templates in your bookkeeping software, click-send, sip coffee, and watch payments roll in — most days. Stay obsessive about tax compliance: track deductions, remit sales tax, and calendar estimated payments so the taxman doesn’t wake you at 3 a.m. Protect yourself with a simple contract, clear payment terms, and liability insurance; I learned that the hard way, you’ll thank me later. Back up files, encrypt sensitive data, and keep records tidy for audits. Small shields, big peace of mind.

Scaling Your Bookkeeping Business: Outsourcing, Niches, and Growth Strategies

If you want to stop trading hours for dollars and actually grow something that hums when you walk away, scaling’s the next honest step — and yes, it’s messier than spreadsheets make it look. You’ll pick outsourcing strategies that feel like hiring muscle: delegate routine entries, SOPs, and spot-checks, then breathe. Choose niche markets so your voice sells — dentists, creatives, e‑commerce — own a corner, charge premium. Use growth tactics like referral bonuses, packaged services, and monthly check-ins that make clients stay. Client retention matters more than one-off wins; nurture trust with predictable reports and a friendly monthly call.

| Task to Outsource | Niche Focus | Growth Tactic |

|---|---|---|

| Data entry | E‑commerce | Referral program |

| Reconciliations | Creatives | Packaged plans |

Conclusion

You’ve got the chops, the laptop, and the coffee-stained ledger—now do the work. Hone skills, set up your space, price with confidence, and hustle for clients. Onboard well, keep neat records, handle taxes, and protect yourself legally. Niche down, outsource when busy, and reinvest profits smartly. You’ll stumble, learn fast, and laugh about it later—so start today, stay steady, and watch your home bookkeeping side hustle become your dependable, profitable routine.